1800 child tax credit december 2021

The American Opportunity tax credit previously called the Hope College credit is valued at 2500 for 2021 up from 1800 in 2008. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

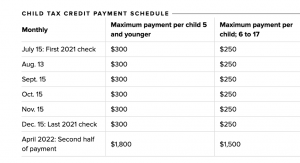

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5.

. Since student 1 turned 24 before 12-31-2020. As per the Finance Act 2021 the rates of income tax for the FY 2021-22 ie. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments.

A family that received a total of 1800 in advance Child Tax Credit payments for their two-year. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Our estimate of your 2021 Child Tax Credit was based on information shown on your processed 2020 tax return including information you entered in the Child Tax Credit Non-filer Sign-up Tool in 2021.

The entire tax credit should amount to 3000 per child this age. In terms of children ages 6 to 17 taxpayers should have received 250 each month per child for a total advanced credit of 1500. Receives 1800 next spring when they file taxes.

Rates of Income-Tax as Per Finance Act 2021. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the. But you are still able to receive the full amount of the 2021 Child Tax Credit.

The Child and Dependent Care Credit was much more generous for 2021. Did you receive early child tax credit payments last year. The child tax credit expired on December 31 2021 after Congress did not renew the program or pass Build Back Better.

Who is Eligible. 1 Rates of tax. Download or print the 2021 Maine Income Tax Instructions Form 1040ME Instructions for FREE from the Maine Revenue Services.

The IRS is sending families half of their 2021 Child Tax Credit. If that family received a total of 1800 in advance Child Tax Credit payments over the final six months of 2021 each spouse would receive their own Letter 6419. The good news is he gets the 1800 recovery rebate credit stimulus when he files his 2020 return.

The final 2021 child tax credit payment gets sent directly to Americans on December 15 Credit. He no longer qualifies as a QC. Those who received advance monthly payments can also claim the remaining credits - up to 1800 per child - by.

To get assistance filing for the Child Tax Credit. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Normal Rates of tax.

If that family intends to file a joint tax return in 2021 they will list 1800 900 plus 900 in Child Tax Credit received on their tax return. This is the tax credit on the books to help families defray their. The much-needed relief money made possible with the help of President Joe Bidens 19trillion American Rescue Plan has been going out Americans across the country since the COVID-19 Stimulus Package was signed into law in the spring.

If you received monthly advance child tax credit payments in 2021 there may be a costly surprise when filing your return this season. Thats a 4800 difference. Heres what IRS Letter 6419 looks like.

Because a tax credit reduces your tax bill dollar for dollar this basically means Uncle Sam will give you up to 2500 per year for each qualifying college student in your family. Received 1800 in 6 monthly installments of 300 between July and December. The amount on each letter will be 900.

You still have half of the credit coming-- another 1800 for kids under 6 and 1500 for kids 6 to 17 ---. By early December 2021 the average refund was 2815. This would have been divided up into 300 each month last year for a total advanced payment of 1800.

Enter Payment Info Here tool or. There is a 4300 income limit for a QR. So his 12k income prevents him from being a dependent for 2020.

Only a QC qualifies a taxpayer for the Earned Income Credit. In the case of every individual other than the individuals referred to in para B and C below. If the enhanced credit lapses at the end of the year the same family would get only 1800 through the child tax credit in 2022.

Assessment Year 2022-23 are as follows. Many parents could toss a key tax-related letter from the IRS relating to child tax credit payments in 2021.

Monthly Child Tax Credit Payments Set To Expire At The End Of The Year

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Income Tax In Germany For Expat Employees Expatica

Child Tax Credit Do You Have To Pay It Back In 2022 Not If You Re In These Cases Marca

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Crypto Tax Guide Germany 2022 Kryptowahrung Steuer 2022 Koinly

Payment Schedule For Ruby S Income Tax Service Facebook

How To Return An Improper Advance Child Tax Credit Payment Nstp

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

The December Child Tax Credit Payment May Be The Last

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Will You Receive A Child Tax Credit Check Wiser Wealth Management

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca